UPDATE: VA Funding Fees were only briefly reduced.

NOVEMEBER 8, 2011 UPDATE: VA Funding Fees are in a political tug-of-war. Per Circluar 26-11-17:

3. Possibility of Congressional Action. VA believes it is highly likely that Congress will pass a bill keeping funding fees at their present level.

Stay tuned. I was surprised to see that the fees were reduced when others are jacking fees up.

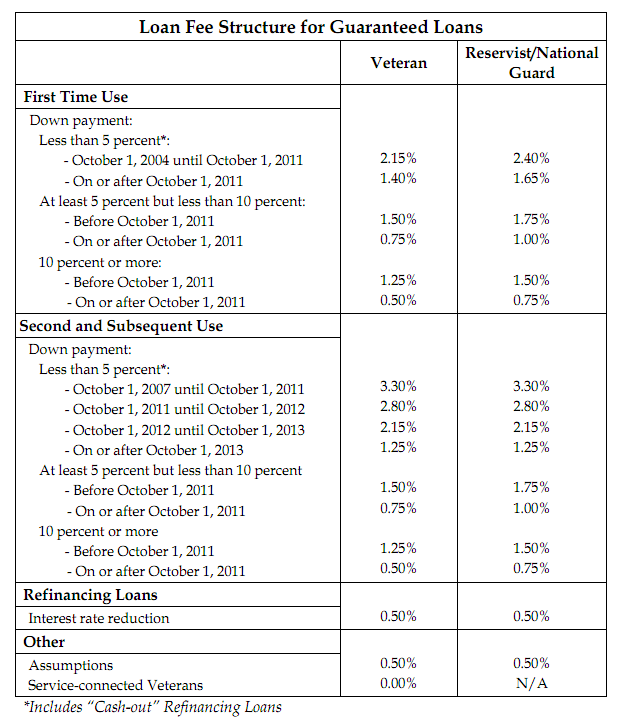

VA mortgage loans that close on or after October 1, 2011 will have reduced funding fees except for IRRL (Interest Rate Reduction Refinancing Loan) transactions, which will remain unchanged at 0.50%. A qualified Veteran with less than 5% down payment, using this benefit for the first time will see the funding fee drop from 2.15% to 1.40%. At a time when it seems many mortgages, like FHA and USDA, are increasing their mortgage insurance fees, it's nice to see VA do something that may have a positive impact.

Here is the VA Funding Fee table from Circular 26-11-12.

Also unlike conforming and FHA insured loans, VA is not restructuring their loan amounts. In King, Pierce and Snohomish County, an eligible service person can purchase a home with zero down payment up to $500,000 with a VA mortgage loan.

If you are selling a home, be sure to consider VA buyers — especially considering that FHA and conforming loan limits are reduced. VA loans are just as easy to close as a conforming loan. Real estate agents, please don't steer sellers away from these transactions. Why exclude any buyer in this (or any) market?

Recent Comments