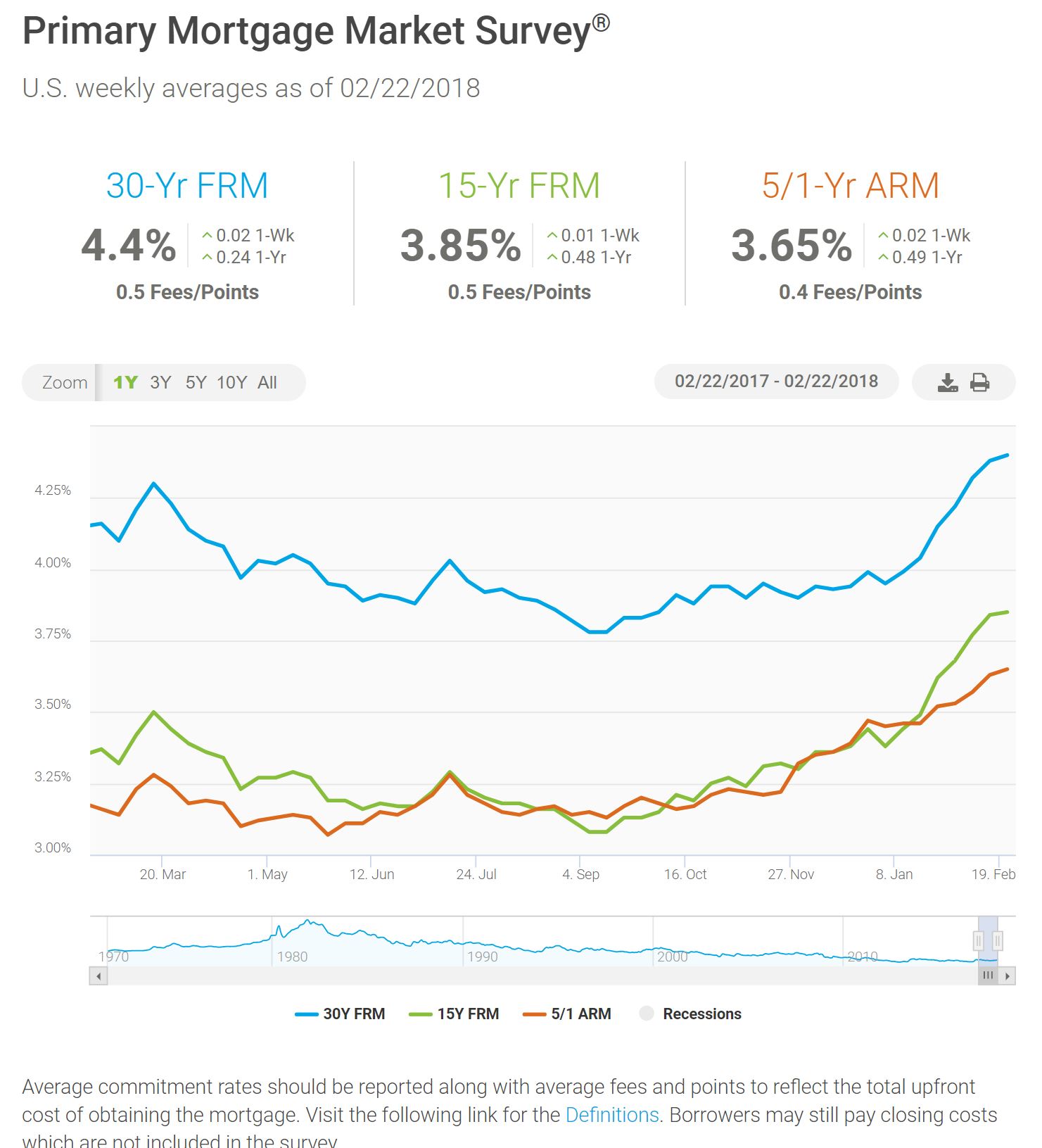

Freddie Mac released their Prime Mortgage Market Survey today showing mortgage rates continuing to trend higher.

The PMMS report is based on an average of conforming rates from last week. This is the seventh consecutive week that mortgage rates have moved higher based on this report.

Historically, our rates are still very low. Don’t believe me? Check this out. [Read more…]

On

On

I’m pleased to announce that Mortgage Master Service Corporation is once again, offering bridge loans to our clients. A bridge loan allows a home owner to tap equity from their current home for down payment on their next home before their current home has sold. With a bridge loan, there are no monthly mortgage payments and the interest that accrues is paid off at the closing of the buyer’s listed home.

I’m pleased to announce that Mortgage Master Service Corporation is once again, offering bridge loans to our clients. A bridge loan allows a home owner to tap equity from their current home for down payment on their next home before their current home has sold. With a bridge loan, there are no monthly mortgage payments and the interest that accrues is paid off at the closing of the buyer’s listed home.

The Washington State Housing Finance Commission (WSHFC) is now allowing borrowers without established credit (aka “non-traditional”) to qualify for a mortgage.

The Washington State Housing Finance Commission (WSHFC) is now allowing borrowers without established credit (aka “non-traditional”) to qualify for a mortgage.

Recent Comments