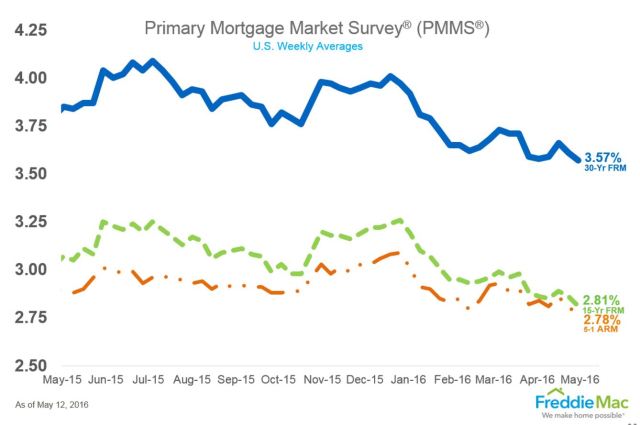

Freddie Mac’s PMMS report was released this morning showing that mortgage rates are trending higher from the 3 year lows.

The Prime Mortgage Market Survey is based on an average of last week’s conforming rates and reports that the 30 year fixed rate averaged 3.66 with 0.5 points for the week ending June 2, 2016. [Read more…]

It’s taking me a couple days to write this post because it’s hard for me to fathom that this month marks my 30th year in the real estate industry. Thirty years ago, I was hired to be a doc puller at Safeco Title Insurance Company. I was promoted to Customer Service and promoted again to work in the title units. This picture of me is from a calendar that Chicago Title created to promote “Unit 5”. And yes, that is Chuck Knox, Coach of the Seattle Seahawks, and my hair was as big as the shoulder pads!

It’s taking me a couple days to write this post because it’s hard for me to fathom that this month marks my 30th year in the real estate industry. Thirty years ago, I was hired to be a doc puller at Safeco Title Insurance Company. I was promoted to Customer Service and promoted again to work in the title units. This picture of me is from a calendar that Chicago Title created to promote “Unit 5”. And yes, that is Chuck Knox, Coach of the Seattle Seahawks, and my hair was as big as the shoulder pads! Mortgage rates have been very low the past couple of days creating a flurry of refinances.

Mortgage rates have been very low the past couple of days creating a flurry of refinances.