Freddie Mac’s PMMS report shows the lowest mortgage rates for the 30 year fixed in over 3.5 years. This is a weekly report based on averages, so this is technically “old news” BUT I really like the direction mortgage rates are currently trending. If you would like to have current rates based on your personal scenario, I can help you with that! [Read more…]

Lowest Mortgage Rates in 3.5 Years says Freddie Mac!

Mortgage Rates Under 6% — Is the Supreme Court Ruling on Tariffs Impacting the Market?

Welcome back to Mortgage Porter Weekly!

After an amazing three-week road trip down to California, the Grand Canyon, and back home to Seattle, I’m officially back in the office and watching the markets closely. And what a week to return — we’re seeing something we haven’t consistently seen in a while…

30-year conforming mortgage rates are trending lower!

That’s getting attention.

The Mortgage Porter Weekly Update – Mortgage Rates Below 6%

Good morning from Astoria, Oregon.

I’m writing this from our room at the Bowline Hotel, with a herd (pod? committee?) of very committed resident sea lions barking below our window. If you’ve stayed here, you know exactly what I mean.

This is where our road trip began—and where it’s ending.

We left from Astoria headed south toward sunshine and desert skies, spending time in Palm Desert and standing in awe at the Grand Canyon. After taking in so much beauty, we decided to come full circle and return to where we started.

There’s something meaningful about that. [Read more…]

The Mortgage Porter Weekly – Mortgage Rates for the Week of February 9, 2026

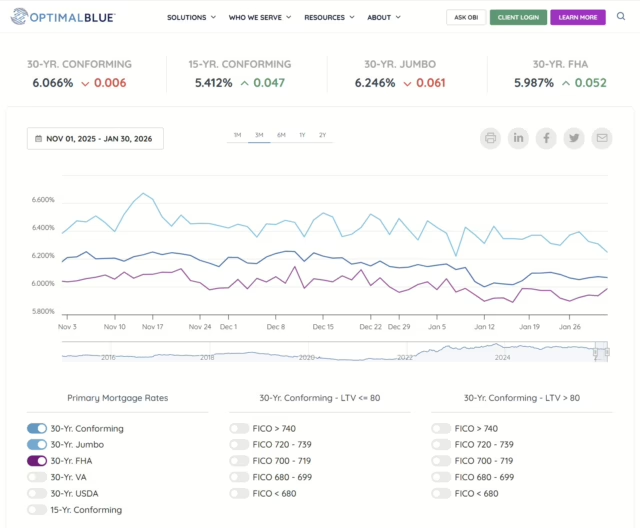

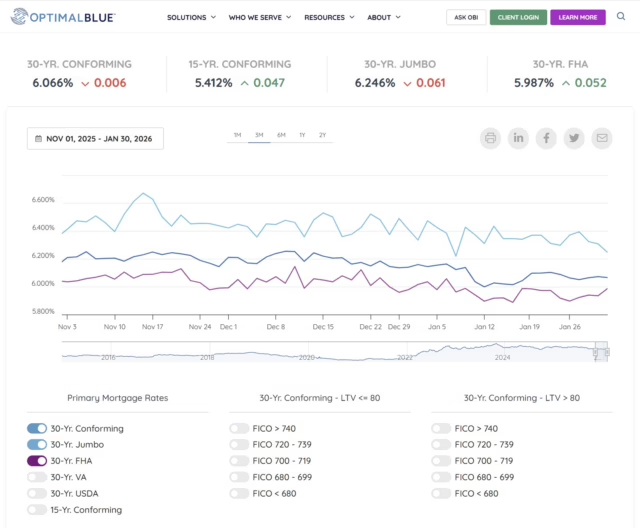

Mortgage rates moved a bit higher last week. As of Friday, February 6, 2026, the average 30-year fixed conforming rate was 6.083% per Optimal Blue. Optimal Blue’s mortage rate index is based on an average from rates that were locked by lenders who utilize OB. We don’t know what the factors are for pricing the rates and these rates are from Friday so they are expired. For current mortgage rates based on your personal scenario, please contact me.

The Mortgage Porter Weekly – February 2, 2026

Even though I’m on the road this week enjoying a little vacation time, I’m still keeping an eye on the mortgage market and the key economic reports that can influence interest rates.

As of January 30, 2026, the **average 30-year fixed conforming mortgage rate is approximately 6.066%. Rates continue to move within a fairly tight range, but this week’s economic data could bring some volatility—especially toward the end of the week.