DFI has announced that Loan Originators who submit the required forms for licensing can continue to do business as usual. This is a change in the original plan of not allowing LOs to take loan applications if they did not submit their MU4 form, fingerprints and application to DFI prior to December 31, 2006. DFI states "Because DFI continues to receive a large volume of applications and because that volume has an impact on DFI’s ability to quickly process the applications, DFI will now allow loan originators to continue originating loans after DFI has received a complete license application. "

DFI has announced that Loan Originators who submit the required forms for licensing can continue to do business as usual. This is a change in the original plan of not allowing LOs to take loan applications if they did not submit their MU4 form, fingerprints and application to DFI prior to December 31, 2006. DFI states "Because DFI continues to receive a large volume of applications and because that volume has an impact on DFI’s ability to quickly process the applications, DFI will now allow loan originators to continue originating loans after DFI has received a complete license application. "

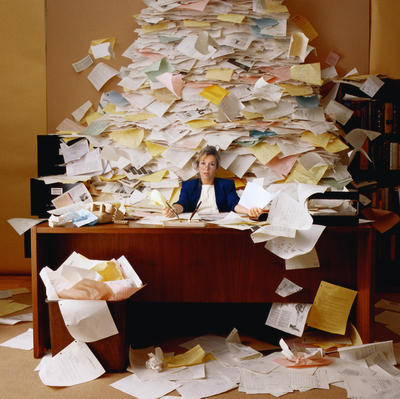

Hmmm….so the LOs who could not follow instructions and submit their information by the deadline get a green light to go ahead anyhow? I cannot imagine how many applications they still needs to wade through and how long the tardy LOs would be out of business (previous decision was that they could not complete a loan application until they received their license from DFI and that DFI would process applications in a first come, first serve basis).

I hope this is not a trend with DFI. Colorado’s similar new law has all ready banned 10 Loan Originators. If Washington state has banned any LOs from this new law, I’m not aware of it. Since I’ve covered this topic in previous post, I thought I should provide you with the current update.