A couple days ago, Fannie Mae addressed questions regarding the high balance loan limits that are set to expire effective with Notes dated October 1, 2011 or later. The current (technically "temporary") high balance limit in the greater Seattle – Bellevue area is $567,500, the new loan limit ("permanent") after September 30, 2011 is $506,000.

Here are some points from Fannie Mae's FAQ's:

Q2. Are the loan limits definitely expiring? What would it take to get them extended or changed from the permanent loan limits?

Congress would have to take action to extend or revise the temporary loan limits, which were originally put in place through the Economic Stimulus Act of 2008 and have been extended through a series of additional legislative actions to provide support to the mortgage market…. The February report to Congress by the Departments of Treasury and [HUD] stated "the Administration recommends that Congress allow the temporary increases in limits that were approved in 2008 to expire as scheduled on October 1, 2011 and revert to limits established under HERA [Housing Economic Recovery Act]." As such, we do not expect any further extensions.

Q3. What will happen in 2012? Could permanent loan limits go down?

…the Federal Housing Agency (FHFA) is required to evaluate loan limits annually, and then revise limits accordingly. The first set of HERA loan limits (a.k.a. "permanent" loan limits) was established for calendar year 2009 based on the median home prices….While there have been median home price declines over the past three years, FHFA followed a policy to "not permit declines relative to the prior HERA [permanent] limits."

…no changes are expected to those permanent limits between October 1, 2011, and December 31, 2011. FHFA has not indicated whether it will continue its policy of not permitting declines in HERA-based limits beyond 2011…2012 loan limits could decline from those that will apply in the fourth quarter of 2011.

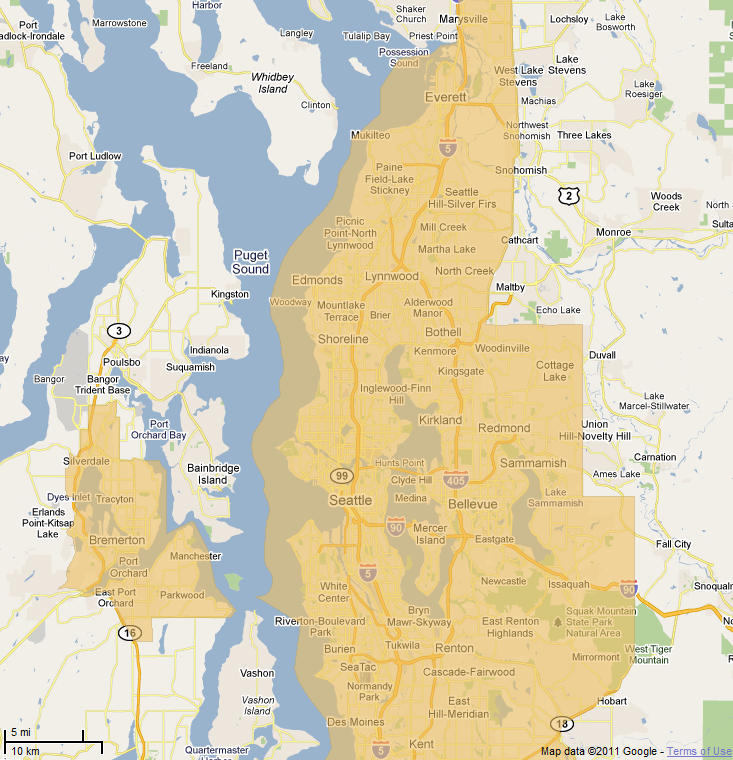

Loan limits for 2012 are expected to be released by FHFA in mid-November of this year. Current counties that have temporary "high balance" loan limits in Washington State are:

- King

- Snohomish

- Pierce

- San Juan

- Kitsap

- Jefferson

- Clark

- Skamania

Only King, Snohomish, Pierce and San Juan Counties will continue to have high balance loan limits from October 1, 2011 to December 31, 2011. The other Washington counties listed (and all counties not listed) above will be returning to a conforming loan limit of $417,000 through December 31, 2011.

We don't know what 2012 brings for loan limits. We should learn more in November.

If you would like me to provide a rate quote for your home located anywhere in Washington, click here.

Recent Comments