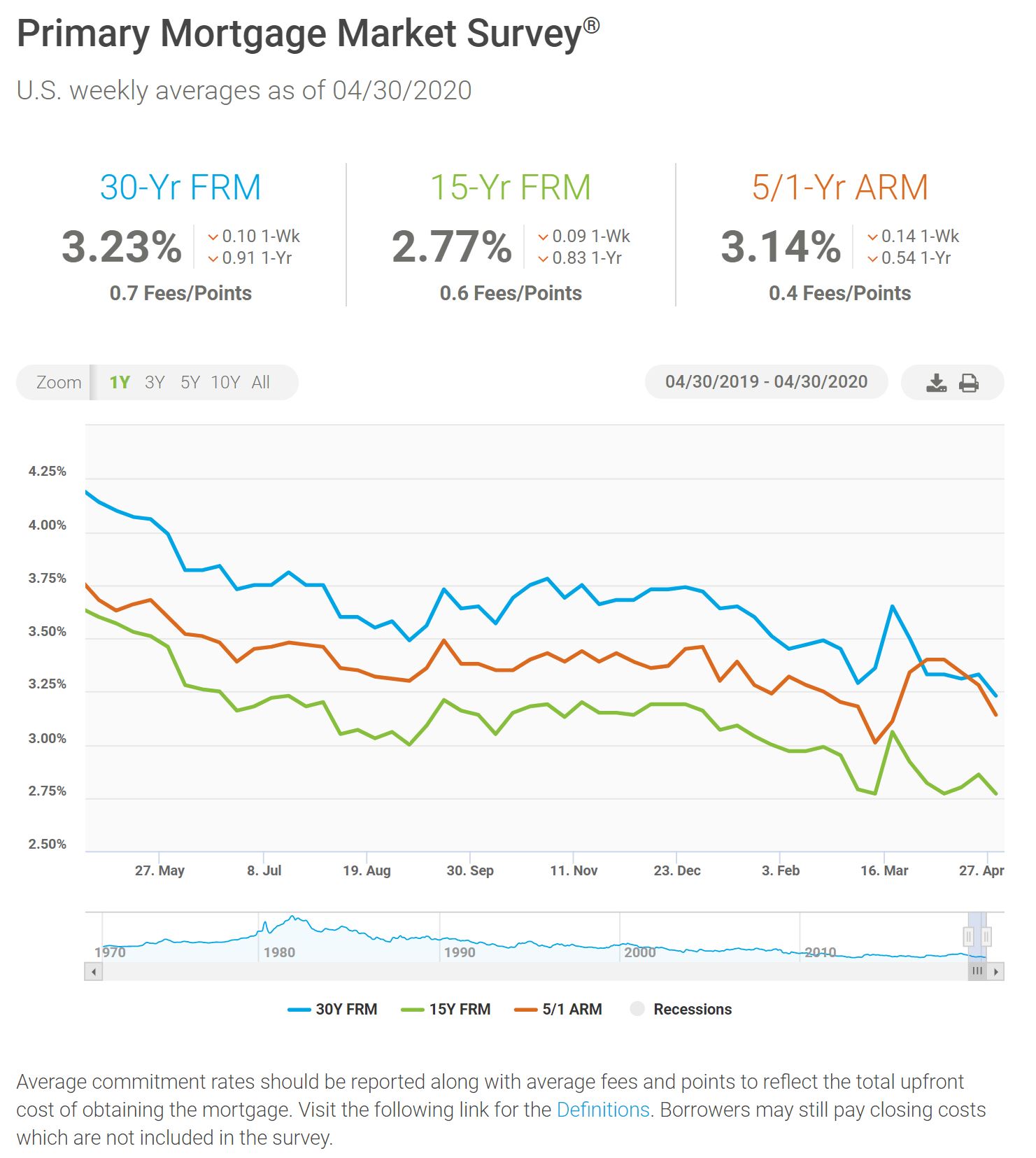

Freddie Mac released their PMMS (Prime Mortgage Market Survey) this morning stating “Mortgage Rates Inch Up“. Even if mortgage rates have bounced slightly higher, they are still ridiculously low. PLEASE REMEMBER: the PMMS data shown in the picture is old news! This is from an average of rates from last week. If you would like current rates for your scenario on your home located in Washington, click here.

What strange times we’re in! Last night,

What strange times we’re in! Last night,  Lately I’ve felt like I’m sitting in the front row of a roller coaster with the wild swings in mortgage interest rates.

Lately I’ve felt like I’m sitting in the front row of a roller coaster with the wild swings in mortgage interest rates.