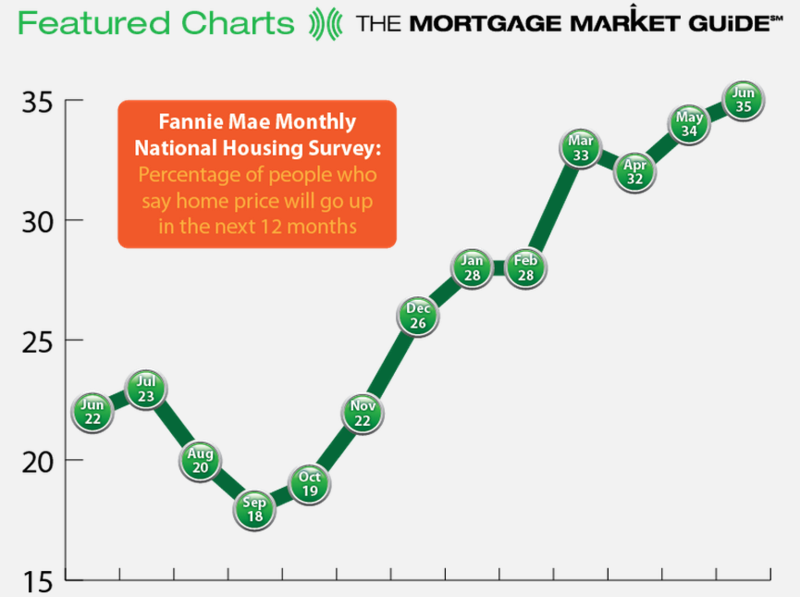

According to Fannie Mae’s Monthly National Housing Survey, many Americans believe that home prices are on the rise. If you are shopping for a home in the Seattle area, you probably know this to be true and may have experienced a bidding war or two.

If you are considering taking advantage of today’s very low mortgage rates and home prices, it’s crucial that you get preapproved by a qualified local mortgage originator.

A preapproval means that you have provided your supporting income and asset documents to prove you have the ability to purchase the home. If you have not provided income and asset documents to your lender, you are most likely not “preapproved” and may only be “prequalified”.

I’m happy to assist with the financing of your home located anywhere in Washington state. It all starts with a review of your financial scenario – click here to start the application process.

Recent Comments