When someone becomes “preapproved” for a mortgage, it boils down to they qualify for a certain mortgage payment based on their income and debts (DTI aka debt to income ratio). A home buyer qualifies for the loan amount of the new mortgage and their funds available for down payment and closing cost determine the sales price.

When someone becomes “preapproved” for a mortgage, it boils down to they qualify for a certain mortgage payment based on their income and debts (DTI aka debt to income ratio). A home buyer qualifies for the loan amount of the new mortgage and their funds available for down payment and closing cost determine the sales price.

How can a preapproval change?

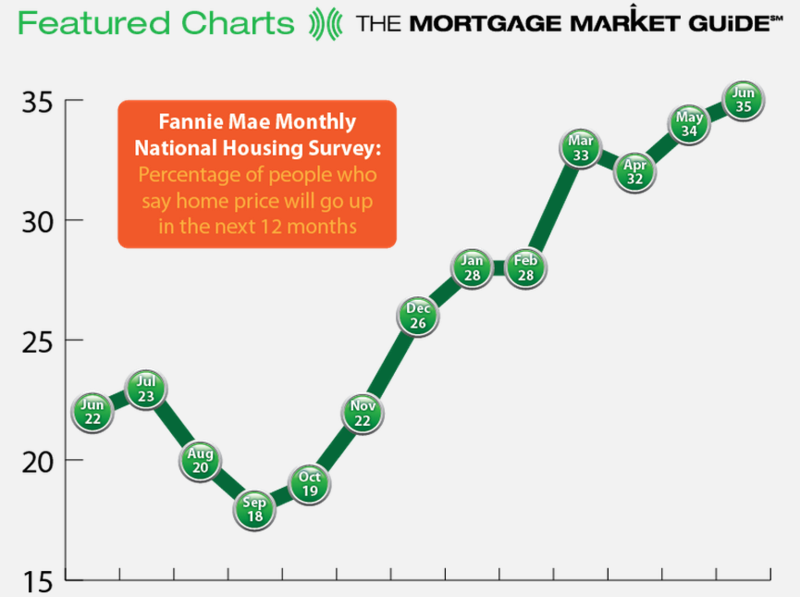

Survey Says!

According to Fannie Mae’s Monthly National Housing Survey, many Americans believe that home prices are on the rise. If you are shopping for a home in the Seattle area, you probably know this to be true and may have experienced a bidding war or two.

If you are considering taking advantage of today’s very low mortgage rates and home prices, it’s crucial that you get preapproved by a qualified local mortgage originator.

A preapproval means that you have provided your supporting income and asset documents to prove you have the ability to purchase the home. If you have not provided income and asset documents to your lender, you are most likely not “preapproved” and may only be “prequalified”.

I’m happy to assist with the financing of your home located anywhere in Washington state. It all starts with a review of your financial scenario – click here to start the application process.

More Listing Agents Performing “Sniff Test” on Mortgage Originators

I’m noticing that more listing agents are performing, what I like to call, “sniff test” to check out the lender who has prepared the preapproval letter. By the way, I think this is an excellent idea. This is especially true if the listing agent is reviewing multiple offers, which is happening more in the greater Seattle area with non-distressed homes that are desirable and priced right.

I’m noticing that more listing agents are performing, what I like to call, “sniff test” to check out the lender who has prepared the preapproval letter. By the way, I think this is an excellent idea. This is especially true if the listing agent is reviewing multiple offers, which is happening more in the greater Seattle area with non-distressed homes that are desirable and priced right.

The sniff test is typically a phone call by the listing agent so they can get an idea about the mortgage originator. The listing agent should not ask personal information about the potential home buyer (such as credit scores or available funds).

When a listing agent contacts me, I know they’re sizing up:

- how quickly I returned their phone call or email

- how experienced I am at closing my clients specific mortgage program (for example, Fannie Mae Homepath, Freddie Mac Homesteps or FHA transactions)

- how long I’ve been in the mortgage industry (over 12 years at Mortgage Master Service Corporation)

- how quickly we can close by

- to learn more about our company (family owned and operated since 1976)

I’ve heard from many local real estate agents that they need to make sure the loan can actually close. Often times, a preapproval letter may not be worth more than the paper it’s written on if the mortgage originator has not done their homework with the actual preapproval. NOTE: you are NOT preapproved unless you have provided your mortgage originator your income and asset documentation.

I wrote about “investigating your preapproval letter” many years ago at Rain City Guide. The issue with preapproval letters then was probably that anybody and their brother was a mortgage originator back in 2007. Now there are far less mortgage originators however, if the mortgage originator works at a bank or credit union, they may still lack experience (they’re not required to be licensed). A licensed mortgage originator may be new to the industry as well. Some large internet mortgage companies have been hiring LO’s who can pass the national exam but still lack experience. There’s a big difference between being a good a passing exams and successfully closing loans.

While the number of mortgage originators is dramatically down, it’s still important to make sure your mortgage originator has the capability to see your transaction to closing. It may be a consideration to make sure your mortgage originator can pass a sniff test.

Reader Question: Does Getting a Mortgage Preapproval Impact my Credit Score?

One of my Seattle subscribers wrote me to ask this great question:

“I’m considering purchasing a home soon, but I’m concerned about getting preapproved too early. If I get preapproved and don’t find a home until the preapproval expires and I need a new one, will the credit hit from the first approval damage the score of my second approval?”

Credit scoring is intended to reflect a persons credit habits. When a credit report is pulled by a mortgage originator, a persons score may go down a few points. The initial pull of your credit report will help determine if there’s anything that needs to be address to help improve your scenario before you find your next home. It’s not uncommon to find that your score may be lower than what you estimated, perhaps there’s a parking ticket, or or a payment was reported late that you’re not aware of. This is the time to find out.

Loan preapprovals generally last around 90 days (this may vary depending on how old your supporting documentation is that was provided to validate your preapproval). Your credit report may not need to be repulled until you have a bona fide offer if at all depending on when your transaction is scheduled for closing. Sometimes a “second preapproval” can be updated with new paystubs or bank statements.

Credit scoring is accumulative. So if you’ve been shopping for a car or a big screen television, these inquiries compounded with one from your mortgage lender will have more of an impact than just the credit being pulled for a preapproval alone. By the way, if you’re shopping for new credit before (or during) being preapproved for a new home, be ready to explain every one of your credit inquiries.

Odds are, if you’re worried about your score dipping from being preapproved you really should proceed with having it pulled by a local, licensed mortgage originator now…just in case a little elbow grease can help pump up your scores. Something as simple as paying down a debt to be under 50 or 30 percent of the total credit line may make a difference for an improved mortgage rate or qualifying for certain mortgage program.

I tend to lean towards getting preapproved as soon as possible. At the very least, it’s an opportunity to develop a game plan to make sure you’re in the best position possible for qualifying for your next mortgage. In addition, I’m seeing more non-distressed home homes in the greater Seattle area that are having multiple offers or “bidding wars”. If you’re considering buying a home, you’re going to need to be prepared with a preapproval letter from a reputable lender. You never know when a home that you want to make an offer on may become available.

If you’re considering buying a home in Seattle, Redmond, Walla Walla or anywhere in Washington, I’m happy to help you with your mortgage preapproval.

Are you really preapproved or just prequalified for a mortgage? Part 2

A preapproval is the next step after becoming prequalifed. Essentially, this means that you are supplying all of the documentation that is required to support your loan scenario. Everything you have told the Loan Originator needs to be backed up for a “full doc” loan. The mortgage originator will review your supporting documentation (W2s, paystubs, asset accounts, credit report—tax returns if you’re self employed or paid commission…etc.) and make sure that they have a strong file for the underwriter. Once you have selected your mortgage program, your information is typically submitted to an AUS (automated underwriting system aka a computer) which produces “findings”. The findings detail what type of documentation is required for the loan approval. Sometimes the findings will require less or more documentation than a mortgage originator has obtained. Different lenders may have their own underwriting overlays in addition to what the AUS has provided.

A preapproval is the next step after becoming prequalifed. Essentially, this means that you are supplying all of the documentation that is required to support your loan scenario. Everything you have told the Loan Originator needs to be backed up for a “full doc” loan. The mortgage originator will review your supporting documentation (W2s, paystubs, asset accounts, credit report—tax returns if you’re self employed or paid commission…etc.) and make sure that they have a strong file for the underwriter. Once you have selected your mortgage program, your information is typically submitted to an AUS (automated underwriting system aka a computer) which produces “findings”. The findings detail what type of documentation is required for the loan approval. Sometimes the findings will require less or more documentation than a mortgage originator has obtained. Different lenders may have their own underwriting overlays in addition to what the AUS has provided.

Are you really preapproved or just prequalified for a mortgage? Part 1

There’s quite a difference between being prequalifed for a mortgage and preapproved. The letters that Loan Originators provide when requested for a prequal or preapproval may appear very similar. In fact, I’ve talked to borrowers on the phone who thought they were actually preapproved, when all they really had was a rate quote worksheet or possible a good faith estimate from a lender. A good faith estimate, loan estiamte or rate quote worksheet are not a commitment to lend and do not indicate that someone has been prequalified.

There’s quite a difference between being prequalifed for a mortgage and preapproved. The letters that Loan Originators provide when requested for a prequal or preapproval may appear very similar. In fact, I’ve talked to borrowers on the phone who thought they were actually preapproved, when all they really had was a rate quote worksheet or possible a good faith estimate from a lender. A good faith estimate, loan estiamte or rate quote worksheet are not a commitment to lend and do not indicate that someone has been prequalified.

What Do You Need for a Preapproval?

If you’re considering buying a home, many real estate agents and/or sellers will require a preapproval letter. A preapproval letter is different than being “prequalified”. Being prequalifed means that you have provided verbal information to a mortgage originator to get an idea of what you qualify for. Being preapproved means that you are providing documentation that supports the information you have provided. Income, employment, assets and credit are verified for a preapproval.

If you’re considering buying a home, many real estate agents and/or sellers will require a preapproval letter. A preapproval letter is different than being “prequalified”. Being prequalifed means that you have provided verbal information to a mortgage originator to get an idea of what you qualify for. Being preapproved means that you are providing documentation that supports the information you have provided. Income, employment, assets and credit are verified for a preapproval.

Some preapproval letters aren’t worth the paper they’re written on. Especially if the mortgage originator you’re working with does not require supporting documentation before preparing the letter. If you have not provided supporting documentation (listed below) to your mortgage originator – you’re probably just prequalified and not actually preapproved.

Here is a list of documents you may be required to provide in order to obtain a preapproval: