USDA Rural loans offers zero down financing to homes located in specific rural areas and to qualified borrowers who’s households who meet income limits.

Many Washington state home buyers have been anxiously waiting to see if they will impacted with the pending changes to USDA boundaries making zero down financing an option.

Recently USDA Rural Development updated their website with maps showing “future eligible areas” which will be based on census data from 2010. The proposed boundaries are set to go into effect as of October 1, 2013 baring Congressional Action.

In order to have access to the maps, you’ll need to agree to USDA’s disclaimer. Simply click the link for “future single family” and enter the property address to see if it is in an a proposed eligible area for USDA financing.

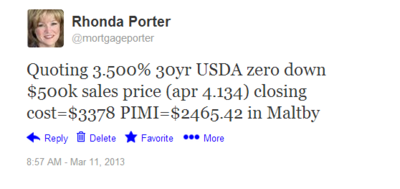

Meanwhile it’s “business as usual” with USDA home loans.

If you are interested in a USDA zero down home loan, or any mortgage for homes located in Washington state, I’m happy to help you!

Recent Comments