I feel it’s important to continue to share with you the junk we receive in the mail from mortgage companies with amazing offers. Seems like the new trend is to go after people who may be facing foreclosures or who have adjustable rate mortgages.

Let’s take a peak inside these great offers!

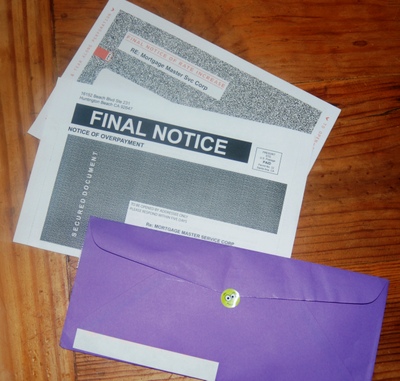

The first one has red letters on the upper right corner stating:

"FINAL NOTICE OF RATE INCREASE". The next line: "RE: Mortgage Master Svc Corp.".

Wow. Looks pretty official and they must know about us because we did get our mortgage at Mortgage Master (where I work). Once you tear open this important looking notice, it appears to be a check from the "funding department" for $375,000. That is our mortgage balance and we do have an ARM. The letter states they have "reviewed our original mortgage loan" and that we "qualify for a Low Cost Refinance or a No Cost Refinance…your new rate could be 4.125% (APR 6.439%)".

The second letter has big bold black says "FINAL NOTICE-Notice of Overpayment". Yikes…we don’t to be overpaying anything! This gem states that "according to their records, you may be making larger than required payments on your home loan" and is offering us a fixed rate for five years at 1.75% (APR 7.012%). Huh? I thought we were making the payment due according to our lender.

The purple envelope really cracks me up. It’s hand addressed on the front and the back of the envelope even has a little smiley sticker. This must be from a dear friend. This is not a mortgage offer, instead they say "We’ll buy your house…even if the stairs are missing". It’s a two page letter with testimonials and reasons not to use a real estate agent…they’ll help you do everything no matter what condition your house is or how desperate you are to sell. RUN! I checked out there website and there is no information about this organization or more importantly, the people who are behind it. Are they licensed? Smells fishy to me. Maybe it’s the smiley sticker. If you need to sell your home and you don’t have a real estate agent to work with, please contact me and I’ll try to help you with a referral to one.

If someone needs to send mail (or do "cold calls") to strangers to stay in the mortgage business, it’s because they do not provide the level of service that would create referrals from their clients. They treat their business/clients as "transactional" instead of "long term relationship". If you’re working with someone who is "transactional", they’re only planning on working with you once; you probably won’t want to return to them for your next mortgage.

I don’t appreciate scare tactics and I hope you don’t fall for their gimmicks. Ask for referrals from people you respect and trust if you are in need of a mortgage or real estate professional (or read their blogs).

PS: If you receive a misleading offer in the mail that does not disclose APR or that appears to be from the government (you know, the gold envelopes with an eagle on the outside usually sent around April so you think it’s a tax refund) and you’re in Washington State, please send it to me. If it’s a violation, I’ll forward it to DFI.

Recent Comments