Beginning October 1, 2011, USDA Rural Loans may an have annual mortgage insurance (like FHA, paid monthly) and will reduce the upfront guarantee fee on purchases from 3.5% to 2%. RD AN No. 4551 states:

Beginning October 1, 2011, it is anticipated that all purchase loans transactions will be charged (1) an up-front guarantee fee equal to 2% of the loan amount and (2) an annual fee of 0.3% of the unpaid principal balance.

Unlike FHA insured loans where the annual mortgage insurance premium ceases after 60 payments and the principal balance reaches 78% loan-to-value based on the original sales price or appraised value, USDA's annual fee NEVER terminates. It will remain a part of the monthly payment until the USDA mortgage is paid off. The annual fee will be reduced each year as it is calculated annually from the principal balance.

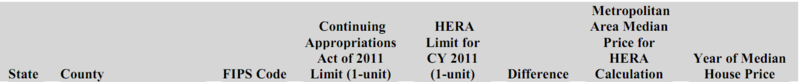

Here's a comparison:

Currently, if someone was using a USDA zero down loan to purchase a home in Duvall for $300,000, their loan amount would be $310,500 (sales price plus 3.5% for the upfront guarantee fee). Based on current rates of 4.375% (apr 4.786), their payment (excluding taxes and home owners insurance) would be $1550.28.

Effective October 1, 2011 and assuming mortgage rates just happen to be the same, the loan amount would be $306,000 (sales price plus 2% for the upfront guarantee fee) creating a principal and interest payment of $1,527.81 PLUS an estimated monthly premium of $75.82 = $1,603.63. An increase of $53.35 per month!

Why would someone even consider having a USDA mortgage after October 1, 2011? Well for one, it's one of the few "zero down" mortgage programs available for homes that are located in a designated rural area (like Duvall, Gig Harbor or Maltby). If the appraisal comes in higher than the sales price, borrowers may be able to finance closing cost… there are some perks to this unique program and it may be worth your consideration if you're income meets the guidelines and you're buying a home in a rural community.

Questions about USDA or other types of mortgage programs for homes located in Washington State? Contact me, I'm happy to help!

Recent Comments