Effective this week, FHA annual mortgage insurance premiums were once again increased on loans with case numbers issued April 1, 2013 or later by 10 to 15 basis points. This is just the first round of changes that were issued with HUD Mortgage Letter 2013-04.

Effective this week, FHA annual mortgage insurance premiums were once again increased on loans with case numbers issued April 1, 2013 or later by 10 to 15 basis points. This is just the first round of changes that were issued with HUD Mortgage Letter 2013-04.

Get Ready for Round 2 of Changes to FHA Mortgages

No Fooling! Time’s Running Out on Reduced FHA Mortgage Insurance Premiums

There are just a few days left before FHA mortgages will have another increase to annual mortgage insurance premiums. Effective with case numbers issued April 1, 2013 and later, FHA annual mortgage insurance premiums will adjust an additional 10 bps to 15 bps.

Five weeks remaining before FHA mortgage insurance premiums increase

HUD has scheduled another increase to FHA annual mortgage insurance premiums effective with new case numbers obtained April 1, 2013 and later. FHA’a annual mortgage insurance premiums are paid monthly and are set to rise by 10 basis points.

For example, a base loan amount of $400,000 with a loan to value of 95% or lower, currently has a monthly mortgage insurance premium of $396.65 based on a rate of 1.20%. After the new mortgage insurance rates go into effect, this monthly premium will be $429.71 – an increase of $33.06 per month.

NOTE: Home owners who currently have FHA insured mortgages for their primary or investment properties and who had those mortgages guaranteed by FHA prior to June 1, 2009 will still qualify for reduced mortgage insurance premiums with FHA streamlined refinances. If you’re not one of these lucky home owners, you may want to take action now!

In addition, with new FHA loans as of June 3, 2013, FHA mortgage insurance will remain on the life of the loan. The only way to terminate it is to refinance out of an FHA loan or pay the loan off. Currently, FHA annual mortgage insurance is set to drop off the loan after it reaches a 78% loan to value and a minimum of 60 mortgage payments have been made. However with a minimum down payment scenario, it often takes closer to nine years before the loan to value reaches 78%. I would bet that many Washington home owners either refinance or sell their homes before their mortgage insurance drops off. Regardless, if you want to avoid having to pay FHA mortgage insurance for the life of that FHA insured mortgage, you’ll need to have your FHA case number prior to June 3, 2013.

What can you do?

If you want to avoid having a higher mortgage payment and you’re considering an FHA loan for your refinance or home purchase, you have a short window of opportunity to secure your lower payment now. An FHA Case number is not your application date. It is actually obtained shortly after you have a bona fide transaction and application. As we near the April 1 date, if you have a new FHA mortgage in process, you will want to confirm with your mortgage professional that your FHA case number has been secured. (They can provide you your FHA case number as proof).

I have been helping people with FHA insured mortgages since April 2000 at Mortgage Master Service Corporation. If you would like me to provide you with a rate quote for your home located anywhere in Washington State, click here.

It’s official: HUD issues Mortgagee Letter Confirming Changes to FHA Mortgage Insurance

I’ve been writing about pending changes to FHA insured mortgage loans regarding the mortgage insurance premiums. Yesterday, HUD issued Mortgagee Letter 2013-04 which makes the proposed changes “official”.

We’ve been anticipating changes to how long mortgage insurance will remain on an FHA insured loan as well as increases to FHA’s mortgage insurance premiums.

It’s no surprise that FHA will increase annual mortgage insurance premiums (paid monthly). The first increase goes into effect with case numbers issued April 1, 2013 and later.

- 30 year fixed with loan to values of 95% or lower will increase to 130 bps (from 120)

- 30 year fixed with loan to values greater than 95% will increase to 135 bps (from 125)

- 30 year fixed FHA Jumbos with loan to values of 95% or lower will increase to 150 bps (from 145)

- 30 year fixed FHA Jumbos with loan to values greater than 95% will increase to 155 bps (from 150)

- 15 year fixed with loan to value of 78.01% – 90% will increase to 45 bps (from 35)

- 15 year fixed with loan to values greater than 90% will increase to 70 bps (from 60)

- 15 year fixed FHA Jumbos with loan to values of 78.01% – 90% will increase to 70 bps (from 60)

- 15 year fixed FHA Jumbos with loan to values greater than 90% will increase to 95 bps (from 85)

NOTE: in the Seattle – King County area, FHA jumbos are loan amounts from $417,001 to $567,500.

But wait… there’s more!!

Effective on case numbers issued June 3, 2013 and later, 15 year fixed FHA mortgages with a loan to value of 78% or lower will have annual mortgage insurance of 45 bps. Currently these loans have zero annual mortgage insurance.

Want to save on your FHA mortgage insurance? Act quickly!! Click here for a mortgage rate quote for homes located anywhere in Washington state.

FHA streamlined refi’s where the current FHA mortgage was endorsed prior to June 1, 2009 are exempt from this adjustment. These loans still qualify for reduced mortgage insurance premiums.

Per the mortgagee letter, this will be effective on case numbers issued June 3, 2013 and later, FHA insured mortgages will change when mortgage insurance can be terminated. Most FHA loans will have mortgage insurance for the term of the mortgage for loans with case numbers issued June 3, 2013 and later.

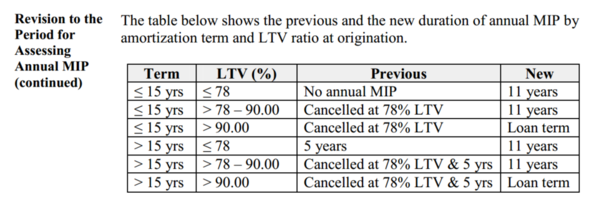

Here is a chart from HUD comparing “previous” (in effect now until the new regulation) and “new” (in effect with case numbers issued June 3, 2013 and later).

FHA Annual Premium Cancellation

If you are considering an FHA insured mortgage and would like to have mortgage insurance that one day drops from your mortgage payment – you have a couple months left to do so. The FHA Case number is typically (but not always) ordered at application.

I am happy to help you with your FHA purchase or refinance on your home located anywhere in Washington state. I have been originating mortgages at Mortgage Master Service Corporation since April 2000, including FHA loans.

Heads up! HUD issues Press Release with upcoming changes to FHA Mortgages

Today HUD issued a press release confirming pending changes to help bolster FHA’s capital reserves.

“These are essential and appropriate measures to manage and protect FHA’s single-family insurance programs” said Galante. “In addition to protecting the MMI Fund, these changes will encourage the return of private capital to the housing market, and make sure FHA remains a vital source of affordable and sustainable mortgage financing for future generations of American homebuyers.”

Some of the changes to take place with HUD have already been announced. Here are a few points from today’s press release

- FHA annual mortgage insurance will remain on the mortgage for the life of the loan. This is the mortgage insurance that is paid monthly. Once this goes into effect, home owners will need to either refinance to a non-FHA loan or pay it off to no longer have mortgage insurance.

- Mortgage insurance is set to increase. The annual mortgage insurance (remember, this is the one that is paid monthly) is set to increase by 0.10 basis points. FHA Jumbos will see an increase in the mortgage insurance by 0.05%.

- FHA Jumbo’s will have a larger down payment requirement. Currently a home buyer can do as little as 3.5% down on all FHA insured mortgages. Once this goes into effect, the minimum down payment for an FHA jumbo will be 5%. In the greater Seattle area, loan amounts over $417,000 and up to $567,500 are currently considered “FHA Jumbos”.

- Manual underwrites for credit scores below 620 with debt to income ratios over 43%. Currently, I believe the lowest credit score our company can do for an FHA insured mortgage is 640.

We are waiting for HUD to issue Mortgagee Letters before this goes into effect.

Stay tuned!

Mortgage Insurance Tax Deduction extended through 2013

With the recent passage of the American Tax Payer Relief Act of 2012, Congress extended the ability to deduct mortgage insurance the same as qualified residence mortgage interest. This applies to homes with private mortgage insurance, FHA mortgage insurance (upfront and monthly) as well as VA and USDA funding fees.

A qualified home, as described by the IRS, is your primary residence or your second home. You cannot collect rent on your second home or it’s…. (are you ready for this?) an investment property and not eligible for this deduction.

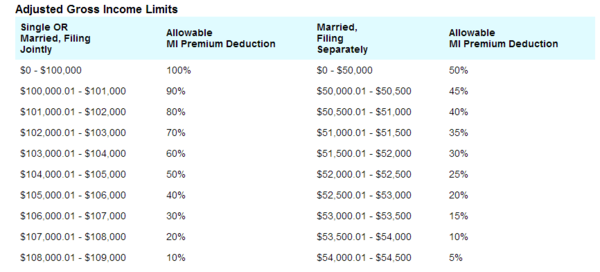

This benefit is phased out for adjusted gross incomes over $100,000. Here is a chart compliments of MGIC regarding how much one may be able to deduct based on AGI:

The amount of mortgage insurance paid is disclosed on the Form 1098, along with the mortgage interest that was paid during that year.

For more information, please contact your personal CPA or tax professional. I am not a CPA, I am a Licensed Mortgage Originator for homes located in Washington state. If I can help you with your mortgage needs for your home located in anywhere in Washington, including Seattle, Sequim or Snoqualime, please contact me.

FHA Mortgage Insurance Increasing in 2013

Last week I shared with you part of HUD’s plan to no longer allow FHA mortgage insurance premiums to terminate to help improve their financial stability. This would be effective for loans guaranteed by HUD in 2013.

HUD also announced in their report to Congress, their plans to increase the MIP (mortgage insurance premiums) paid on FHA insured loans by an additional 0.10 basis points (or 0.1% of the loan amount). From HUD’s press release:

In 2013, enact an increase of 10 basis points or 0.1 percent to the annual insurance premium paid by borrowers on new FHA loans. This premium increase is expect to add $13 per month for the average borrower and will strengthen FHA’s capital position without limiting access to credit for qualified borrowers.

In the greater Seattle area (King, Pierce and Snohomish Counties), the FHA loan limit (as of today) for a 1-unit single family dwelling is $567,500. An increase of 0.1% for this loan amount would cost an FHA borrower an additional $47.29 per month.

If you are considering an FHA mortgage for your refinance, I highly recommend you do so as soon as possible while your mortgage insurance premiums may still be cancelled instead of for the life of the loan AND before the mortgage insurance premiums are increased.

If your home is located anywhere in Washington state, where I am licensed to originate mortgages, I can help you!

FHA Mortgage Insurance to remain on loans FOREVER

HUD has announced in their Annual Report to Congress Regarding Financial Status of the FHA Mutual Mortgage Insurance Fund Fiscal Year 2012, their plan to revise the cancellation of FHA mortgage insurance premiums. This is set to go in effect on new FHA insured mortgages sometime in 2013.

From HUD’s report:

Under a policy change made in 2001, FHA has been cancelling required mortgage insurance premiums (MIPs) on loans for which the outstanding principal balance reaches less than 78% of the original principal balance. However, FHA remains responsible for insuring 100% of the unpaid principal balance of a loan for the entire life of the loan, such loan life often extending far beyond the cessation of the MIP payments. As written, the timing of MIP cancellation is directly tied to the contract mortgage rate, not the actual loan LTV. The current policy was put in place at a time when it was assumed that home price values would not decline, but today we know that LTV measured by appraised value in a declining market can mean that the actual LTVs are far lower than amortized mortgage LTV, resulting in higher losses for FHA on defaulted loans. Analyses conducted by FHA’s Office of Risk Management projects lost revenue by approximately $10 billion in the 2010-2012 vintages as a result of the current cancellation policy. The same analyses also suggest that 10%-12% of all claims losses will occur after MIP cancellation. Therefore, beginning with new loans endorsed after the policy change becomes effective later in FY 2013, FHA will once again collect premiums on FHA loans for the entire period during which they are insured, permitting FHA to retain significant revenue that is currently being forfeited prematurely.

With FHA running out of funds, they are having to take measures to protect this mortgage program. You can also expect to see mortgage insurance premiums (upfront and annual) to increase in addition to FHA mortgage premiums remaining on the life of the loan.

What does this impact you?

If you currently have an FHA mortgage, your mortgage insurance premium that you pay monthly is still set to drop off (cancel) once your principal balance reaches 78% of the loan to value and a minimum of 60 mortgage payments have been made.

However, if you currently have an FHA mortgage in the mid-to-high 4% range and you have been considering an FHA streamlined refinance, you need to act quickly.

If you are considering buying a home and you are planning on using FHA for financing, be prepared to have the FHA mortgage insurance remain on the loan until you either sell the home or can refinance to a conventional mortgage.

If you are interested in buying or refinancing a home anywhere in Washington state, I’m happy to help you!

Recent Comments