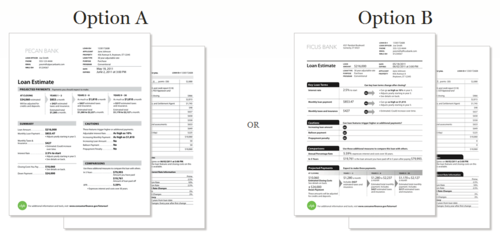

The Consumer Protection Financial Bureau would like you to vote on two different proposed mortgage disclosure forms created to replace the current Good Faith Estimate and Federal Truth in Lending documents. You have until Friday to make your selection between the Pecan Bank or the Ficus Bank examples. Both contain (and are missing) the same information.

I personally prefer Ficus Bank (the darker example) as it discloses key information at the top of the form, including the interest rate and monthly payment. The Pecan example features projected payments along the top section along funds due at closing being the very first box on the form. I've written more about the proposed disclosures at Rain City Guide. It's really a choice of style and arrangement of content.

I still believe that most consumers would rather return to a detailed Good Faith Estimate featuring all closing cost itemized instead of having certain cost lumped together where it's hard to see exactly what they're paying for. Why not have the Good Faith Estimate resemble an estimated HUD-1 Settlement Statement so that there is congruency between the beginning of the transaction and closing?

I've provided my opinions and vote to the CFPB, have you?

After you visit CFPB's site and have voiced your opinion, I'd love to know which selection you made and why.

Recent Comments