The Talon Group, a local escrow and title company, addresses which utilities are required to be paid at closing.

Helping Washington State homeowners learn more about their mortgage options.

The Talon Group, a local escrow and title company, addresses which utilities are required to be paid at closing.

EDITORS NOTE: This is an updated version of this post which was written at a time when mortgage originators could more freely use the Good Faith Estimate as a tool to communicate with their clients. Due to HUD's 2010 GFE and the accompanying restrictions, this is no longer probable. In fact, nowhere on today's Good Faith Estimate is funds for closing disclosed! Seattle area borrowers and homebuyers can still avoid surprises at escrow…hopefully these "updated" tips will help!

Your closing date on your new home is a couple of days away, your feeling a little case of the jitters…the last thing you want to deal with is to be surprised with what funds are due at your signing appointment with the escrow company.

Here's how you can clear up the funds to close issue:

What if there are errors? Try not to panic. Depending on how much time there is prior to the scheduled funding, the lender may be able to redraft loan documents if needed. A majority of our loans are funded within our credit lines so unless it involves someone having to be re-approved for a higher loan amount, loan documents can be emailed fairly easily to the escrow company. Often times, it could just be correcting a few documents and not the entire loan package.

The closing table can be an emotional time. It's in your best interest to have as many of the details worked as far in advance as possible. If you have questions or concerns, speak up. This is not the time to be bashful. This is your mortgage and one of the largest financial transactions you will make in your lifetime…get involved and take action!

I often wonder how a consumer can truly trust a mortgage originator who sits in a housing development or a real estate office. Yes, it's convenient when you're checking out that new home and the loan originator that works with the builder or real estate company just happens to be sitting there waiting for you or the next person who'll walk through their door. Is that the best option for you?

I often wonder how a consumer can truly trust a mortgage originator who sits in a housing development or a real estate office. Yes, it's convenient when you're checking out that new home and the loan originator that works with the builder or real estate company just happens to be sitting there waiting for you or the next person who'll walk through their door. Is that the best option for you?

HUD is questioning this with regards to builders with in-house lenders and if this arrangement is a RESPA violation. It is harmful to consumers if the closing costs or rates are increased to compensate for what the lender may have to shell out to be that builder's preferred lender. Often times, you may find that the builder has built any cost to bribe you to work with their lender by increasing the sales price of the home. RESPA violations aside, I've always felt that if you work with the builder's lender, you're providing your personal information to the "seller" or the more specifically, the employee of the seller. The loan originator may be employed by a bank, but when they're constantly fed by the builder…where do their loyalties rest?

I feel the same way about loan originators who work as "joint ventures" with real estate companies. They may be paying rent inside your real estate agent's office or just be on their preferred providers list with some sort of business arrangement. I believe most of the big real estate brokerages in the Seattle area have an arrangement made to steer you to their lender, title or escrow company. When a loan originator, title rep or escrow officer are constantly fed or partially owned by a real estate company–where are their loyalties? If you only want to get approved for a $400,000 sales price, and can afford to much higher–do you think the LO who's shacked up with the real estate agent will let that agent know when they press the LO for more info on you?

Yes, you pay for their origination, title or escrow fees, but who are these people really work for. Shouldn't you have more of a choice? Some real estate agents will tell you that there isn't much difference in rate or fees–which they may truly believe; however, it may not be accurate.

I "work for" Mortgage Master Service Corporation. I'm paid by the consumer when we close a mortgage transaction together. My business is dependent on my clients referring me to people they know who need a mortgage in the greater Seattle area. I also have clients who find me from reading my blogs. I am not part of any joint venture or arranged business agreements. I'm not paid based on volume, quotas or selling a certain type of program.

Bottom line as a borrower in one of the largest transactions you may ever make in your lifetime, it is your responsibility to make sure you have the right team working for you. Do as much research as possible before you've entered into a real estate contract.

Photo credit: Sarah G… via Flickr

If you’re a long time reader of The Mortgage Porter, you know that my pre-mortgage career was in the title and escrow industry. One of my early jobs was preparing documents to be recorded at King County. Later in my career, as a sales rep, I would sometimes have the opportunity to “be a hero” by driving “rush recordings” directly to the court house in Seattle and either meeting the title company’s recorder or actually having to “walk on” the documents myself. Recordings are the deeds and deeds of trust that will be recorded at the county to become public record to give the world notice that you now own the land or have debt attached to the property. (It also gives scammers notice to hound you with loan and other offers).

If you’re a long time reader of The Mortgage Porter, you know that my pre-mortgage career was in the title and escrow industry. One of my early jobs was preparing documents to be recorded at King County. Later in my career, as a sales rep, I would sometimes have the opportunity to “be a hero” by driving “rush recordings” directly to the court house in Seattle and either meeting the title company’s recorder or actually having to “walk on” the documents myself. Recordings are the deeds and deeds of trust that will be recorded at the county to become public record to give the world notice that you now own the land or have debt attached to the property. (It also gives scammers notice to hound you with loan and other offers).

On a recent transaction, I learned that all title companies are not the same when it comes to how the manage their recordings. When a title company receives documents from the escrow company, they are typically “on hold” meaning–do not record yet; or they’re a “walk on” which means, record as soon as possible. It’s my understanding that most title companies keep holds at King County UNLESS they have verified with the escrow company that the documents are not scheduled to close for some time.

This transaction involved a title company who apparently keeps recordings for King County at their Lynnwood office until they know they are released for recording and then they are sent with their recording courier. Problems can arise when recordings are released later by escrow or if the courier faces high volumes of traffic with her commute to Seattle (what are the odds of that?). I have been informed by their Senior Title Officer that they are changing their policy on keeping holds at their office.

It could be worth asking your preferred King County title provider:

Where do they keep recordings that are on hold?

Will they do a special courier to the court house if needed? (a title rep can do this)

Hopefully the recordings are kept at King County (or the appropriate county) so that in the event of a later release, the documents are prepared and ready to go to avoid delays with closings.

Related Post:

What Takes Place Between Signing and Closing

HUD has unveiled their new "Shopping for your Home Loan – HUD's Settlement Cost Booklet". What was once a ppamphlet that was included with your loan application has been replaced by a 49 page booklet. This revised guide for borrowers was created to accompany HUD's new Good Faith Estimate which goes into effect on January 1, 2010.

HUD's new guide is to help consumers navigate the new Good Faith Estimate. I'm not going to go all the way through it on this post, I do want to point out issues with HUD's Home Purchasing Time Line (which you'll find on page 4).

Do you see anything wrong with this picture? Let's review step by step.

1. Determine what home you can afford. I agree with this. What home you can afford may be different than what home you qualify for. You don't have to buy as much home as you may qualify for and you might qualify for less than you desire. What's most important is being able to afford the home. I think this step is referring to doing some serious gut checking and reviewing of your personal budget BEFORE meeting with a real estate agent or mortgage originator.

2. Find a real estate agent. I think step two should be to find a mortgage professional instead of the agent. They have the cart before the horse with this step. The last thing a home buyer needs is to be shown a bunch of home they may not qualify for. Meeting with a mortgage originator first will help them narrow down what programs they qualify for that will suit their financial needs (I think this is HUD's Step 5). Agents may debate me on this because they like to direct buyers to their preferred lender.

3. Find a home and negotiate the terms. This is unbelievable! HUD is recommending that you enter into a binding contract before knowing if you're approved for the mortgage. Yes there are financing contingencies, but you do not tie up a seller's property when you don't even know that you can close on a transaction. Plus, most real estate agents will not show you a home until you have been preapproved by a mortgage professional.

4. Shop for your loan — compare multiple good faith estimates. This is very flawed. HUD's new good faith estimate carries RESPA reform which in a nutshell means that if a mortgage originator provides a borrower a good faith estimate, they are presumed by HUD to have obtained enough information from you to have created a loan application. This creates a certain amount of liability for the mortgage originator that in this day and age, most will not accept. Not to mention that rates change constantly, sometimes several times a day. If anything, you should shop for the most qualified mortgage professional and not "the loan" or rate…this step should take place around Step 2.

5. Chose the loan that's best for you. This should take place at step 2 or 3 (after you select your mortgage professional). This is too late in the game to be determining your financing.

6. Loan originator processes the loan. Your mortgage originator begins processing your loan at application for purposes of preparing your preapproval letter. Your loan may actually go into processing and underwriting once you are proceeding with your transaction.

7. Have house inspected. This typically take place after you find your home and have negotiated your contract. You're not going to want to be paying for an appraisal (which would take place at processing) if your potential home doesn't pass inspection.

8. Shop for other service providers (title, attorney, escrow agent). Is this a HUD after thought? If you are going to shop for your title or escrow, you're going to need to do this prior to the contract being written as the purchase and sales agreement dictates who the providers will be (unless the agent writes "buyers choice"). Plus, HUD's new GFE dictates how much the title and escrow fees can change at closing based on if you shop or if you allow the lender to select these service providers.

9. Loan is approved. There are different steps of loan approval. This is most likely "final loan approval" meaning all conditions (documentation) have been provided and reviewed by underwriting.

10. Get insurances and do final walk through. I recommend shopping and selecting your home owners insurance much earlier in the process. Once you have a bona fide contract and your home has passed inspection, you can start shopping for your insurance agent.

11. Go to settlement. In Washington, you're probably going to your signing appointment at the escrow company a couple days before closing. Sometimes signing will feel like it's at the eleventh hour!

12. Move in.

Watch formy next post where I share how I think this purchasing time line should look.

I have been wondering how HUD’s new GFE, which goes into effect on January 1, 2010 will impact title and escrow companies. It appears as though HUD would like to see the borrower have the possibility of more control in selecting those services instead of the current system where typically in our area of Washington, either the real estate agents thumb wrestle over their favorite title or escrow company or the lender may select. Rarely does the consumer have a voice in who will be providing the title insurance on their home or who will be the “neutral third party” facilitating the closing one of their largest transactions in their lifetimes.

From a local escrow and title provider The Talon Group’s blog:

The current local practice of the seller choosing title insurance appears to be at odds with HUD reform that attempts to put the buyer back in the drivers seat. HUD makes no bones about it’s intentions for empowering buyers to shop for the best deal possible when choosing title and settlement services. Also going into effect January 2010, lenders will face strict guidelines and tight tolerances when listing these services on the new Good Faith Estimate.

The “tolerances” define what the variance in costs for title and escrow/settlement services may be between the (soon to be) binding good faith estimate and the settlement statement at closing. The tolerances for title and escrow fees fall into a couple “buckets”:

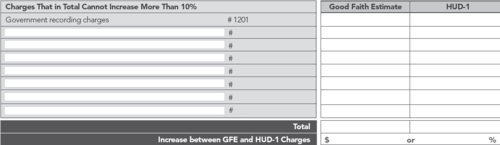

10% tolerance:the accumulative fees for title and escrow services cannot exceed higher than 10% of what was disclosed on the good faith estimate.

Not subject to tolerance; there is no limit to what the difference may be at closing verses what was disclosed on the good faith estimate.

With these tolerances set forth on the new good faith estimate, I wrote an article at Rain City Guide predicting that the big banks will use the new Good Faith Estimate as a reason to mandateto their mortgage loan originators they must only use their “in-house” or affiliated providers and may not recommend outside escrow or title companies for service–regardless of established relationships or a proven track record of excellent service. I believe this will follow in the footsteps of HVCC where banks are using AMCs (appraisal management companies) that they have ownership interest in–even if the HVCC fiasco is fixed, I think you’ll see banks still insisting that an AMC is used and will use the new GFE to gain title and escrow revenue. They’ve tasted the gravy.

If we mortgage originators had more flexibility of when a good faith estimate could be revised for our clients, I would be applauding the last page of the revised HUD-1 Settlement Statement. On this page, the borrower actually get to compare the closing costs on the good faith estimate directly to the those shown at closing on the estimated HUD-1 Settlement Statement side by side. My beef is that we are very limited by HUD's grey definition of "changed circumstances" which allows us to issue an updated good faith estimate.

The page 3 of the HUD-1 also breaks the fees into the various tolerance levels. The first section has the fees that cannot increase. If the HUD-1 fees in the right column are higher than those in the Good Faith Estimate column on the left, the mortgage originator will have to refund the difference.

The next section has the fees where HUD will allow an accumulative variance of up to 10%.

Followed by the last section where the tolerance does not apply. The fees shown in the section below can change from the good faith estimate.

Page 3 of the HUD-1 Settlement Statement concludes with a summary of the loan terms. Hopefully none of these terms (or fees) are a surprise to the borrower, their mortgage originator should have explained the details fully well in advance of the signing appointment.

Ideally, mortgage companies will provide loan documents a few more days in advance than what is taking place with our current GFE/HUD and RESPA guidelines…this means longer transaction times for consumers. I also highly recommend that consumers obtain a copy of their estimated HUD-1 Settlement Statement two days before their scheduled signing appointment.

I've always recommended that borrowers bring their good faith estimate with them to their signing appointment, maybe now they won't need to!

November 11, 2009 – Veterans Day (all offices closed)

November 25, 2009 – King County closed. Snohomish County closes early at 3:30 pm.

November 26 – 27, 2009 – Thanksgiving (all offices closed)

Remember that on Friday's Snohomish and Kitsap Counties close early and to hug your Escrow Officer and Funder.

PS: November 30, 2009 is the deadline for closings for the first time home buyer tax credit. The last day King County is open prior to Monday, November 30, 2009 is Tuesday, November 24, 2009. Not a lot of wiggle room for error should there be any mis-haps at closing. Also keep in mind that since the furlough closures are due to budget issues, I highly doubt our counties will add extra staff or pay overtime to accomodate the huge record of recordings that may be taking place this date. Between the potential redisclosure issues with MDIA and HVCC, hopefully first time home buyers are planning on closing in mid-November to avoid the insanity!

![]() Rhonda Porter is a Licensed Mortgage Originator MLO121324 living in the greater Seattle area. Rhonda began her career in 1986 in the title and escrow industry and began her mortgage career in 2000. She enjoys helping people understand the mortgage process and started writing The Mortgage Porter in late 2006. Read More…

Rhonda Porter is a Licensed Mortgage Originator MLO121324 living in the greater Seattle area. Rhonda began her career in 1986 in the title and escrow industry and began her mortgage career in 2000. She enjoys helping people understand the mortgage process and started writing The Mortgage Porter in late 2006. Read More…

Copyright © 2024 · Education Child Theme on Genesis Framework · WordPress · Log in

Recent Comments