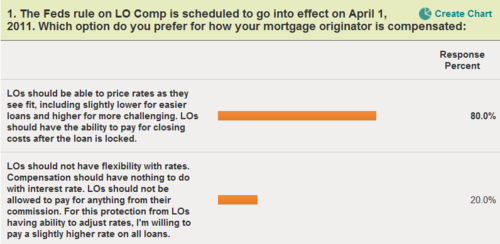

I posted a survey last week with three questions regarding loan originator compensation for people who either have or who are considering obtaining a mortgage. Here are the results as of 7:20 this morning (click image for a better view).

80% of those who took the poll would rather allow their mortgage originator to have the freedom to price rates as they choose and to be able to use their commission to help with cost after locking (typically at closing).

20% would rather that rates were detached from the LOs commission and are willing to pay a slightly higher rate in order to have this "protection" and have the LOs commission restricted from being allowed to go towards any cost.

The results are overwhelming. Consumers would much rather leave mortgage originator compensation alone. They do not want government interference with how a mortgage originator is paid. Many mortgage originators do not want this rule either even though many will actually receive a "raise" since their commission will be fixed (no pricing leaning on an easier loan) and their commission is forbidden to be used in the transaction for anything (including helping out paying for an extension or other closing cost).

The Fed's Rule on "LO Comp" has been delayed by dramatic intervervention late Thursday (the eve before the the rule was to go into effect) by the U.S. Circuit Court. We should have more information this Tuesday.

As of right now, you'll find that some mortgage companies and banks are proceeding with the rule and others are holding back until more is learned on Tuesday. This can make a significant difference in your interest rate so you may want to check with your mortgage originator if you're locking on Monday if they are proceeding with the Fed LO Comp rule or not.

Mortgage Master Service Corporation is delaying following the Fed Rule on LO Comp until we learn more on Tuesday from the Circuit Court Judges. This means that I have freedom to price and lock your rates as I see as "fair" for at least one more day.

I will be posting mortgage rates tomorrow morning on my blog "as usual". It could be my last mortgage rate post where I'm able to quote rates based on how I want to price them.

Related post:

The Feds Loan Originator Rule is a bad April Fools Joke on You, the Consumer

Please leave a reply