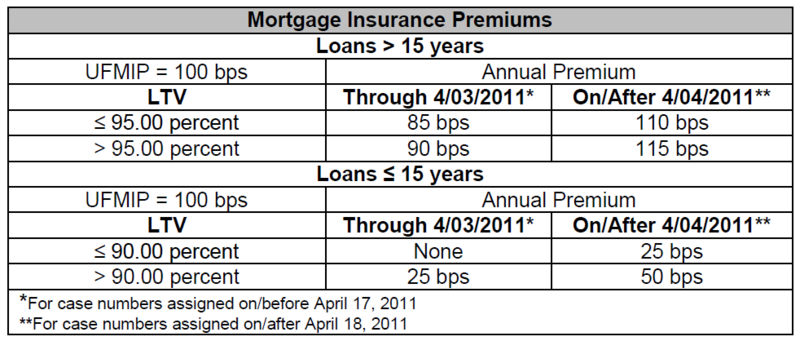

Yesterday HUD issued Mortgagee Letter 11-10, making it official that FHA annual mortgage insurance will increase another 0.25% basis points on case numbers issued on or after April 18, 2011. The annual mortgage insurance is included in the monthly mortgage payment. There is no change (at this time) to the upfront mortgage insurance which is paid for at closing (typically financed or may be paid as a closing cost). This is in line with the Obama Administration's plan for reforming mortgages which was revealed on Friday.

Here's how this will pencil out for a 30 year fixed mortgage based on a sales price of $400,000 with a minimum down payment of 3.5% (base loan amount of $386,000).

FHA mortgages with a case number issued prior to April 18, 2011 (current as of this post):

386,000 x .90% = 3,474/12 months = $289.50.

FHA mortgages with a case number issued April 18, 2011 or later:

386,000 x 1.10% = 4,246/12 months = $353.83

Difference in monthly payment: $64.33.

This will also impact FHA 203k rehab loans.

Remember, FHA annual mortgage insurance remains on the loan for a minimum of 60 payments regardless of loan to value. Even if a home buyer is putting down 20% towards the purchase of their Seattle area home, they will still have FHA mortgage insurance. FHA mortgage insurance will also remain on the home until the loan balance reaches 78% of the loan to value based on the original appraised value or purchase price of the home (which ever was less).

I have been originating FHA insured loans for the past eleven years at Mortgage Master Service Corporation (a Direct Endorsed HUD approved lender). I am licensed to originate mortgages for homes located in the State of Washington. If I can help you with your mortgage needs, please let me know!

Please leave a reply