You may want to check with your preferred mortgage originator to make sure they have fully renewed their license for 2011. If they have not, or if they started the process late and are waiting for their 2011 license from DFI, they might not be able to legally take a loan application next week.

Some mortgage originators are not required to be licensed. Thanks to Congress, the SAFE Act allows mortgage originators who work for credit unions or depository banks (like Wells Fargo, Chase and Bank of America) to only be registered. It's unfortunate that our elected officials did not create the SAFE Act to have the same standards for any mortgage originator who takes a residential loan application.

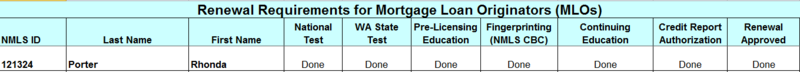

Washington State Mortgage Originators who are required to be licensed should check on DFI's website to make sure they have met all the steps required to originate loans in 2011. If certain steps are missing, including the renewal being approved, DFI has it clearly flagged as "needed". Some mortgage originators have yet to pay for their renewal fees which will also prevent them from taking a loan application as a licensed mortgage originator as of January 1, 2011.

I am fully licensed to originate mortgages for homes located in Washington State. I received my 2011 license from DFI in mid-November.

From DFI:

"As of [Dec. 22, 2010] 59% of Washington MLOs successfully renewed and have been issued their 2011 license. This percent represents 4,381 individuals who will be working as MLOs come January 1st."

Note: MLO = Mortgage Loan Originator.

If you find your mortgage originator has not completed the steps to be NMLS licensed in 2011, it's possible that they may have decided to work for an institution that is not required to be licensed (depository bank or credit union) or perhaps they simply procrastinated. If you find they're not fully approved to take an application in 2011 per this list, you may want to ask them directly what their plans are for the new year.

Mortgage Originators (MLOs) who allow their license to expire may have to go through additional steps to renew and may be subject to additional fees.

If you are a Washington State Mortgage Originator - do double check DFI's list to make sure you have everything set for 2011.

Please leave a reply