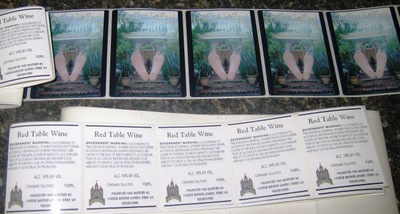

Last Friday, our crew assembled to complete our wines we started weeks ago at Castle Bridge Winery. It was a lot of fun…down to designing our own label (and labeling the bottles, too). The wine is a Amorone style and will be ready to drink in a few months (depending on how picky your taste buds are).

The wine is a Amorone style and will be ready to drink in a few months (depending on how picky your taste buds are).

We did spend quite a bit of time laughing. The folks at Castlebridge are very kind and helpful.

We know what we’re giving for Christmas, bringing over to Thanksgiving dinner…you get the idea.

We know what we’re giving for Christmas, bringing over to Thanksgiving dinner…you get the idea.

Our label is "ChaToe LaFeet" and those are my husband’s floating feet on the label. Watch for it in your finer restaurants (NOT).

Our group shot is me, Rob, Julie, Marla and Cliff.

Recent Comments